Awe-Inspiring Examples Of Tips About How To Fight Credit Card Lawsuit

Up to 25% cash back if you're sued by your credit card company, there are some defenses that can help you.

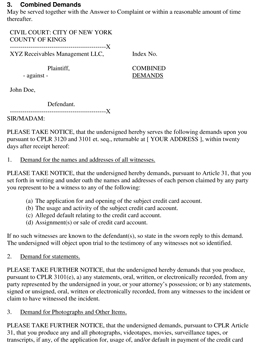

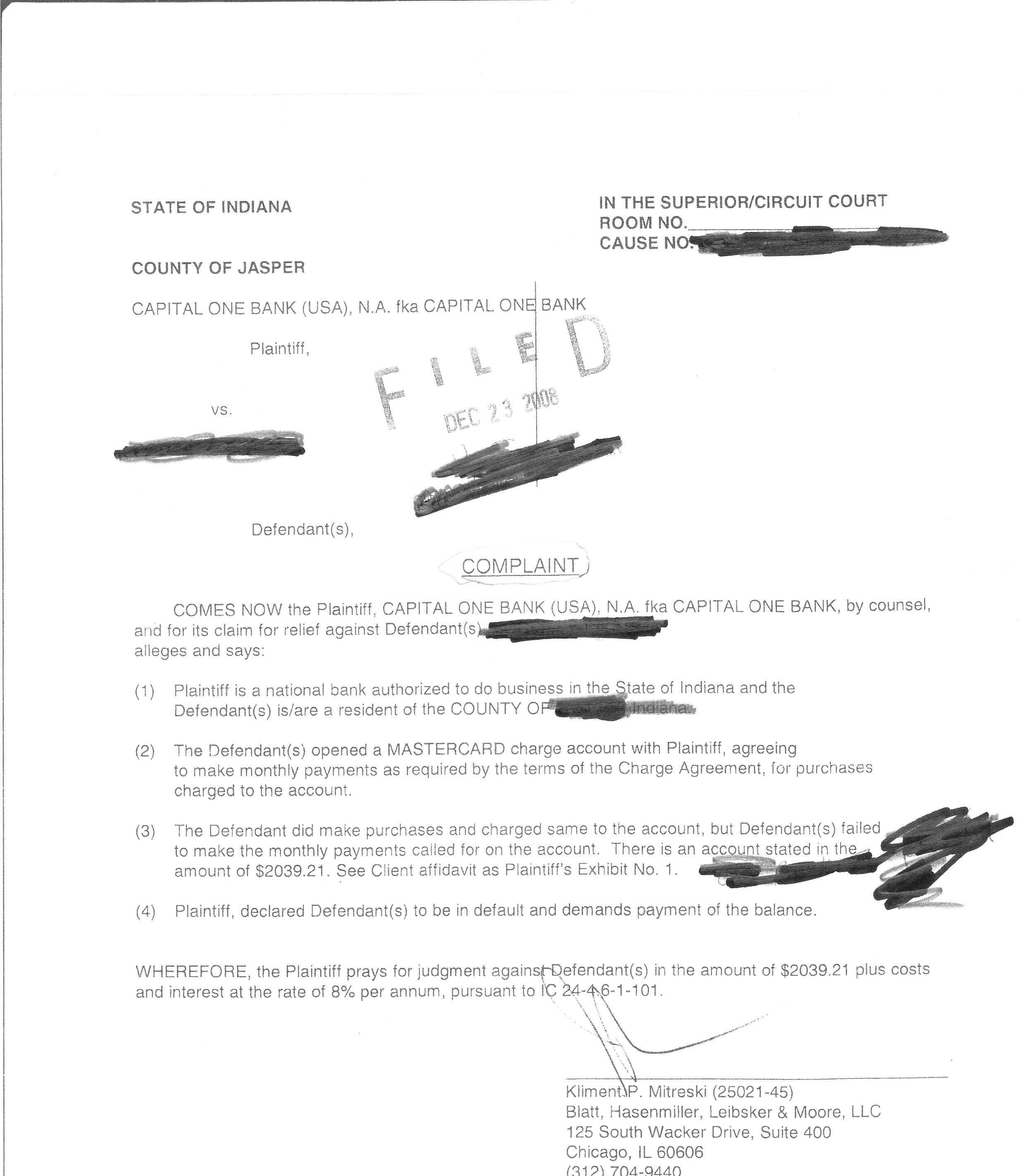

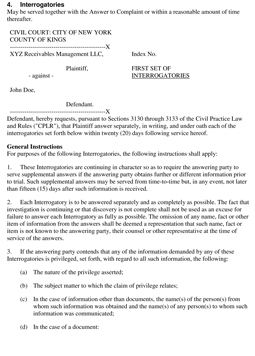

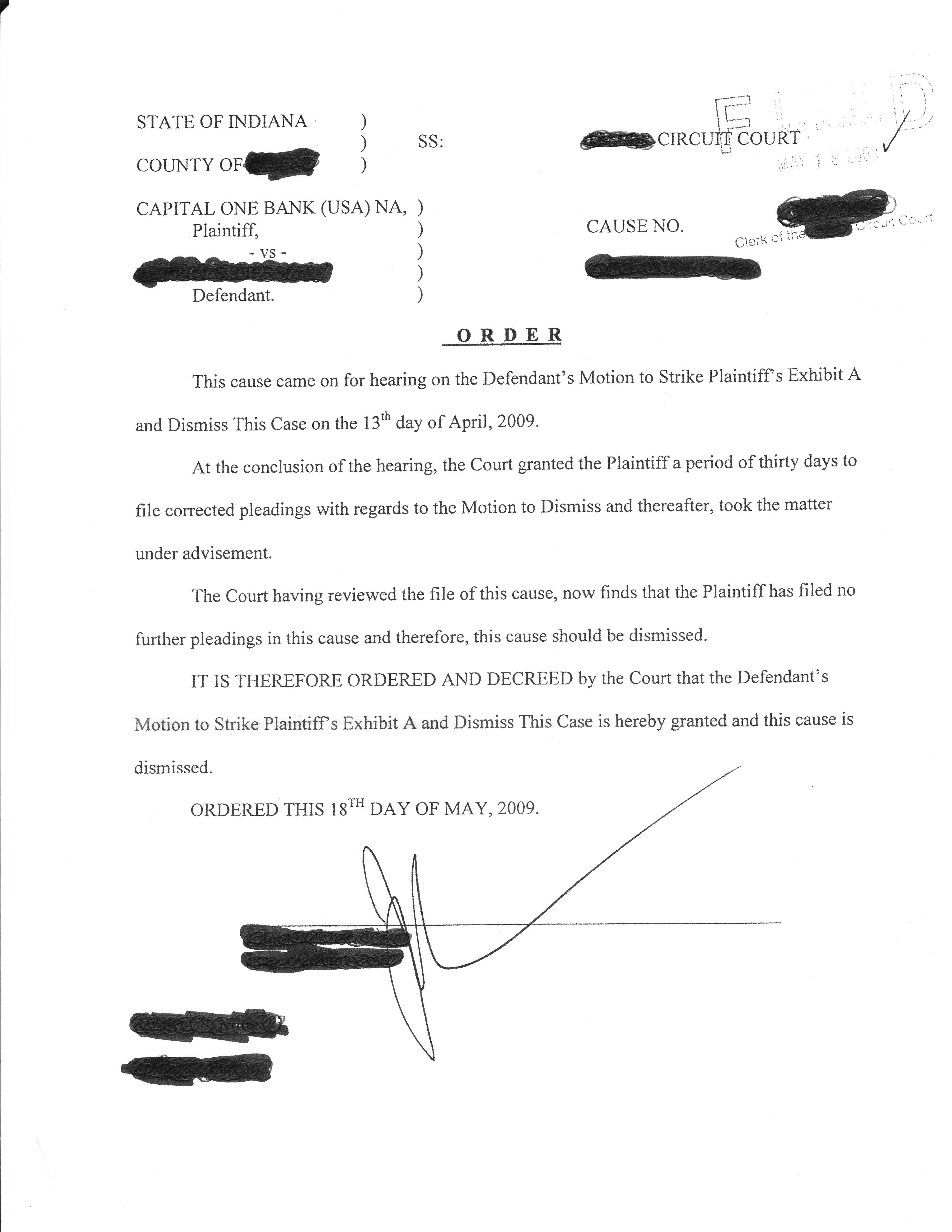

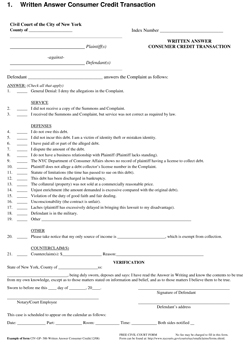

How to fight credit card lawsuit. Your credit card company will start the lawsuit by filing a complaint in court. The final step in responding to your credit card lawsuit is to file all pertinent documents with the court clerk. The credit card company must file a lawsuit within four years after your debt became due or the case will be dismissed because it’s outside the statute of limitations.

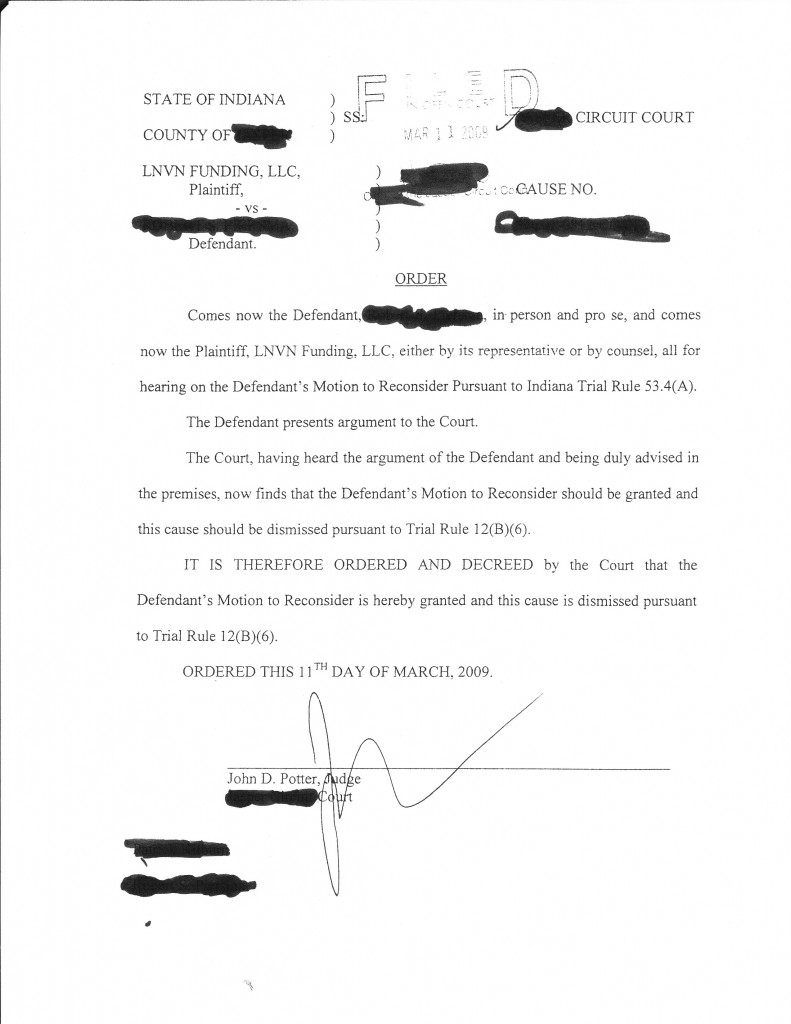

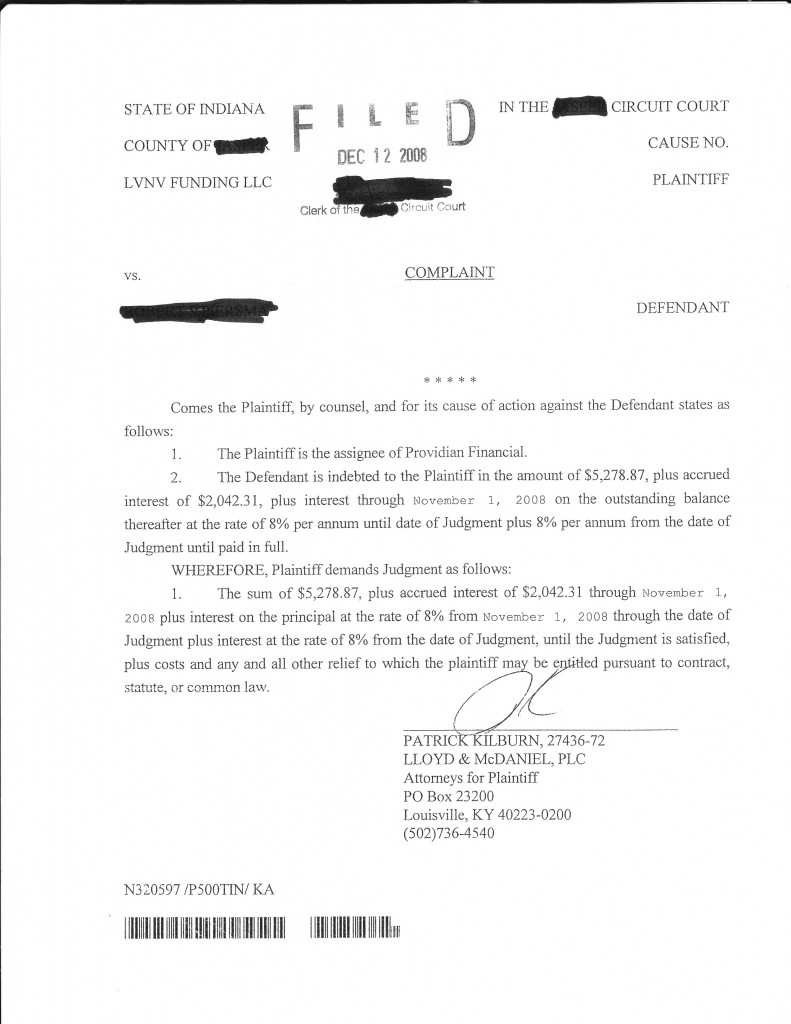

It applies to suits over. Proof of assignment. this demonstrates that the debt. Represent youself in an attempt.

More often than not, your debt has changed hands multiple times before the current collection agency purchased it and is now suing you for it. Request proof that the debt was assigned, i.e. The most important regulation for debt collection firms is the fair debt collection practices act (fdcpa), which is both a federal law and an arkansas law.

How to fight a credit card lawsuit knowledge. The cost is passed on to consumers in the form of higher interest rates and fees. If the lawsuit is for a credit card debt and there are charges on the account which were the result of a data breach or ‘identity theft’ where someone charged your credit card, you would have an.

August 15, 2022 lawfirms, lawyer Attempt to negotiate with the debt collector; When a credit card company or debt collector sues you, it will serve you with a.

Make the plaintiff prove what you owe. This is not the way to respond to being sued for a credit card consumer debt. Once you have been served with a credit card lawsuit, you typically have five options to choose from: