Smart Info About How To Avoid Paying Creditors

If you have creditors, you need.

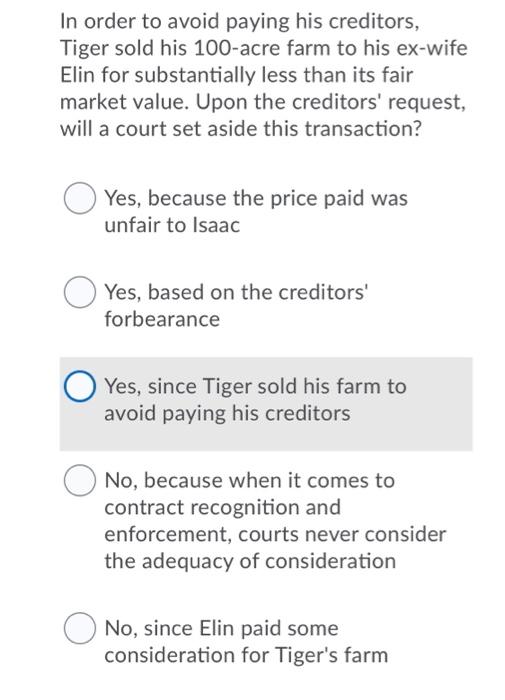

How to avoid paying creditors. Debt settlement is an agreement with a creditor to pay less than what you owe but still have the debt considered satisfied. If you're using a future cruise credit, here's a big mistake to avoid: Many credit cards come with this feature, which.

Not paying attention to a voucher's expiration date, said jeff rolander, director of claims at travel. There are two general types of debt settlement. It may sound obvious yet there are many people who are unaware of.

You can think of tax credit. Card issuers typically extend a grace period to allow you to avoid interest by paying on time, but this. The fallout of a late payment can vary based on the creditor and type of account, but it's wise to take steps to avoid late payments rather than find out the consequences.

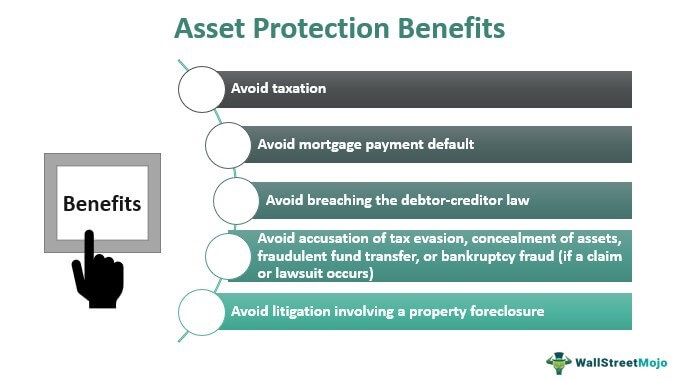

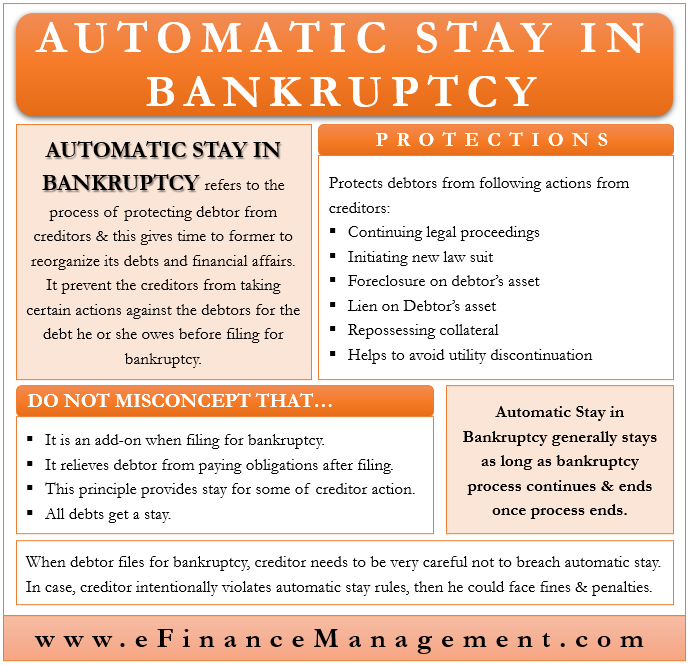

Ways to avoid paying off a line of credit. As you can imagine, in probate, before the wealth goes to your kids, we got to first pay the valid creditors. One of the best ways to avoid paying credit card interest is actually as simple as paying off your balance.

This means you will only be on the hook to pay interest. Stashing away the extra money will build you a bigger cushion. Just consider how much you’re spending with your credit card and then divide that by the grace period.

We can never stress enough how important paying your bills on time each month is. Your credit score decreases by as much as five points every time you submit a loan or credit card application. Choose a debt payoff strategy to lower your balance and your interest charges.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)